The Banking Cabal

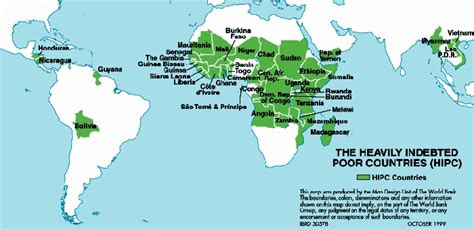

How Bankers Shaped the World Bank and the Global Financial Order

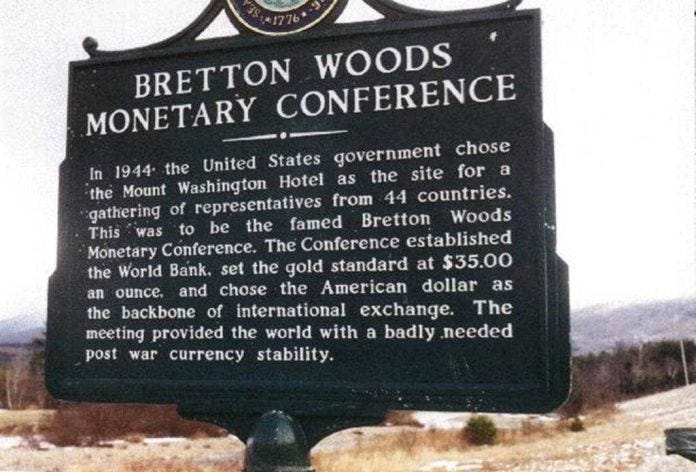

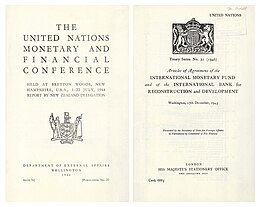

In the wake of World War II, the global landscape was in turmoil, requiring substantial rebuilding efforts and new economic strategies. The establishment of The World Bank in 1944, often presented as a beacon of hope for reconstruction and development, has a more complex and controversial history. The institution was born from the Bretton Woods Conference.

The Bretton Woods Conference brought together 730 delegates from 44 allied nations at the Mount Washington Hotel in Bretton Woods, New Hampshire, United States. The conference aimed to establish regulations for the international monetary and financial system in the aftermath of World War II. It was ostensibly gathered to ensure post-war economic stability. However, beneath the surface, there were intricate webs of influence involving powerful corporations and financial institutions whose roles in the war and its aftermath warrant scrutiny.

Prominent figures like British economist John Maynard Keynes and American Treasury Secretary Henry Morgenthau Jr. are frequently credited with shaping The World Bank.

Yet, the involvement of influential banking families and corporate interests in both the war's funding and the formation of post-war institutions raises critical questions. These entities, with their deep financial stakes, appear to have played significant roles in the orchestration and outcomes of the war, including the tragic events of the Holocaust.

The narrative of The World Bank's creation is interwoven with the activities of these powerful players. Their influence extended beyond mere economic recovery, potentially aligning with broader agendas that shaped global policies and financial systems. This perspective challenges the conventional view of The World Bank as a purely benevolent force, suggesting a need to reexamine the motivations and actions of those involved in its inception.

Exploring the origins of The World Bank requires confronting these unsettling connections. By addressing the less-discussed aspects of its history, we can better understand the complex forces at play and the true impact of this influential institution on the global stage.

While it is often heralded as a pivotal moment for establishing a new framework for international economic cooperation and rebuilding the post-war world, the true nature of the conference and its underlying motives are more complex and contentious.

Ostensibly, the Bretton Woods Conference aimed to create a system that would promote economic “stability” and prevent the kind of financial turmoil that contributed to the Great Depression and the ensuing global conflict. Delegates from 44 allied nations came together to design institutions that would regulate the international monetary and financial order, resulting in the creation of the International Monetary Fund (IMF), International Bank for Reconstruction and Development (IBRD, later part of the World Bank group), and the Bretton Woods system for international commercial and financial relations.

The deeper agenda behind the conference was driven by powerful financial and corporate interests. These entities, many of which had profited immensely during the war, sought to establish a system that would ensure their continued dominance in the global economy. The conference was, in many ways, a strategic move to secure their financial interests and to shape a new world order that favored the economic elite.

Key figures such as John Maynard Keynes and Harry Dexter White, who represented the United Kingdom and the United States respectively, played central roles in the negotiations.

Yet, behind them were influential banking families and corporate entities whose goals were not merely about economic recovery but about cementing their control over global financial systems.

The Bretton Woods Conference thus stands as a landmark event not just for its outcomes, but for the power dynamics and hidden agendas that influenced its proceedings.

Understanding the real motives and interests at play provides a more nuanced view of how global economic policies were shaped in the aftermath of World War II, revealing the intricate connections between war, finance, and international governance.

The Bretton Woods System was an international monetary arrangement established in 1944 that pegged major currencies to the U.S. dollar, which in turn was convertible to gold, aiming to ensure stable exchange rates and promote global economic stability. However, it faced criticism for its reliance on the U.S. dollar as the primary reserve currency, leading to imbalances and contributing to its eventual collapse.

In 1971, President Richard Nixon suspended the dollar's convertibility into gold, a decision driven by mounting trade deficits, inflation, and the strain of financing the Vietnam War, which exposed the system's vulnerabilities. Although the Bretton Woods System itself is no longer in operation, the institutions created during the conference, such as the International Monetary Fund (IMF) and the World Bank, continue to play significant roles in global economic governance and development.

The World Bank, originally established in 1944, has undergone significant changes and expansions since its inception. The key institutions involved with The World Bank and their name changes over the years are as follows:

1. International Bank for Reconstruction and Development (IBRD)

Original Name: International Bank for Reconstruction and Development (IBRD)

Current Name: International Bank for Reconstruction and Development (IBRD) - remains unchanged.

Role and Activities Post-WWII: The IBRD was established to provide loans and financial assistance for the reconstruction of war-torn Europe and for the development of other nations. In its early years, the IBRD focused on funding infrastructure projects, such as roads, schools, and hospitals, to stimulate economic recovery and development in member countries.

2. International Monetary Fund (IMF)

Original Name: International Monetary Fund (IMF) - name unchanged.

Role and Activities Post-WWII: The IMF was created alongside the IBRD to ensure global monetary stability and provide financial support to countries facing balance of payments problems. Initially, the IMF's role involved stabilizing exchange rates and facilitating international trade by providing short-term financial assistance to member countries in need.

3. International Finance Corporation (IFC)

Original Name: International Finance Corporation (IFC) - name unchanged.

Role and Activities Post-WWII: Established in 1956, the IFC was created to promote private sector development in developing countries by providing investment and advisory services to businesses. It aimed to support economic growth by fostering private enterprise and facilitating foreign investment.

4. International Development Association (IDA)

Original Name: International Development Association (IDA) - name unchanged.

Role and Activities Post-WWII: Created in 1960, the IDA was established to provide concessional loans and grants to the world’s poorest countries, where traditional lending might not be feasible. The IDA aimed to reduce poverty and support economic development in low-income nations through financial and technical assistance.

5. Multilateral Investment Guarantee Agency (MIGA)

Original Name: Multilateral Investment Guarantee Agency (MIGA) - name unchanged.

Role and Activities Post-WWII: MIGA was established in 1988 to encourage foreign investment in developing countries by providing political risk insurance and credit enhancement to investors and lenders. Its goal was to promote economic development by mitigating investment risks.

6. International Centre for Settlement of Investment Disputes (ICSID)

Original Name: International Centre for Settlement of Investment Disputes (ICSID) - name unchanged.

Role and Activities Post-WWII: Established in 1966, ICSID was created to provide facilities for the arbitration and conciliation of investment disputes between governments and foreign investors. It aimed to foster a stable investment climate by resolving conflicts and ensuring fair treatment for investors.

Early Years After WWII

In the immediate post-war years, The World Bank and its affiliated institutions focused on several key areas:

Reconstruction Efforts: The IBRD provided loans to help rebuild war-torn infrastructure in Europe and other regions. This included funding projects in transportation, energy, and social services to support recovery and development.

Economic Stabilization: The IMF played a crucial role in stabilizing global currencies and facilitating trade by providing financial support to countries facing balance of payments issues. Its efforts were essential in preventing economic crises and fostering international economic cooperation.

Private Sector Development: The IFC began its operations to stimulate private investment in developing countries, aiming to enhance economic growth through support for businesses and infrastructure projects.

Poverty Alleviation: The IDA focused on addressing poverty and supporting development in the poorest countries by offering concessional financing and technical assistance.

Investment Protection: MIGA and ICSID were later established to enhance investment climates by providing risk insurance and resolving disputes, contributing to a more secure environment for international investments.

Overall, these institutions purportedly worked together to support global economic recovery, promote development, and stabilize the international financial system in the years following World War II.

The World Bank’s establishment and its alignment with the goals of the United Nations (UN) reflect broader aspirations for global economic stability and cooperation following World War II.

Here’s how The World Bank fit into the UN's goals and the reasons for its headquarters location, along with information about its branches:

Alignment with United Nations Goals

Global Cooperation and Peace: The UN was founded in 1945 with the primary goal of promoting international peace and security. The creation of The World Bank was part of a broader effort to ensure global economic stability and prevent the conditions that could lead to future conflicts. By providing financial support for reconstruction and development, The World Bank aimed to address the economic disparities that could contribute to unrest.

Economic Development and Poverty Reduction: The UN’s charter includes goals related to economic development and improving living standards worldwide. The World Bank’s mission to support reconstruction and development, especially through institutions like the International Development Association (IDA), directly supports these UN goals by targeting poverty reduction and fostering economic growth in developing countries.

International Collaboration: Both the UN and The World Bank represent the collective effort of member countries to address global challenges through collaboration. The World Bank’s establishment was part of the Bretton Woods system, which aimed to create a cooperative international monetary system. The UN and The World Bank work together to address global issues through their respective mandates.

Headquarters in Washington, D.C.

Strategic Location: The decision to locate The World Bank’s headquarters in Washington, D.C., was influenced by the significant role the “United States” played in post-war economic reconstruction and its leading position in global finance. The U.S. was a key architect of the Bretton Woods system and a major contributor to the initial capital of The World Bank.

Political and Economic Influence: Washington, D.C., as the capital of the United States, was a strategic choice given the country’s political and economic influence at the time. The U.S. was seen as a central player in shaping the new international economic order, and having the headquarters in the capital highlighted this role.

Branches and Offices

While The World Bank has a central headquarters in Washington, D.C., it operates through a network of branches and offices worldwide to carry out its mission effectively:

Regional Offices: The World Bank has regional offices that focus on specific geographic areas. These offices coordinate regional projects and provide support tailored to local needs. Key regional offices include:

Africa: Offices in cities like Addis Ababa (Ethiopia) and Nairobi (Kenya).

Asia: Offices in cities like New Delhi (India) and Jakarta (Indonesia).

Europe and Central Asia: Offices in cities like Istanbul (Turkey) and Moscow (Russia).

Latin America and the Caribbean: Offices in cities like Lima (Peru) and Rio de Janeiro (Brazil).

Middle East and North Africa: Offices in cities like Cairo (Egypt) and Beirut (Lebanon).

Country Offices: The World Bank also maintains country offices in many member nations. These offices work closely with national governments and local organizations to implement projects and provide financial assistance tailored to specific countries’ needs.

Specialized Centers: In addition to regional and country offices, The World Bank has specialized centers focused on particular issues, such as the World Bank Institute (WBI) for knowledge and capacity building, and the Development Economics Vice Presidency (DEC) for economic research and analysis.

The World Bank’s global presence through its offices and branches helps it effectively address development “challenges”, “implement” projects, and “support” member countries in achieving economic stability and growth.

Member Countries at the Bretton Woods Conference

The Bretton Woods Conference in 1944 was attended by representatives from 44 allied nations.

These countries, all of whom were part of the Allied forces in World War II, played a role in shaping the new international economic order. The participating countries included:

United States

United Kingdom

France

China

Soviet Union

Australia

Belgium

Brazil

Canada

Chile

Czechoslovakia

Denmark

Egypt

Greece

India

Iran

Iraq

Lebanon

Luxembourg

Mexico

Netherlands

New Zealand

Norway

Panama

Peru

Poland

Saudi Arabia

South Africa

Syria

Turkey

Uruguay

Yugoslavia

Citizen Awareness and Influence

Awareness and Public Information:

Limited Awareness: During and immediately after World War II, the general public had limited awareness of the specifics of the Bretton Woods Conference or the establishment of The World Bank and the IMF. Media coverage was sparse compared to today’s standards, and the complexities of international finance were not widely communicated to the public.

Government Communication: While there were official announcements and some public information about the conference and the creation of these institutions, detailed discussions about their implications and operations were largely confined to policymakers and financial experts.

Citizen Influence:

Indirect Influence: Citizens did not have direct input into the decisions made at Bretton Woods. The conference was a high-level meeting of government representatives and financial experts, and the public’s role was indirect, mediated through their elected officials.

Representation Through Governments: In democratic countries, the policies and international agreements endorsed by their governments reflected, to some degree, the will of the people. However, the specific negotiations and decisions at Bretton Woods were not subject to direct public participation or scrutiny.

Public Understanding of Impact:

Limited Knowledge: Many citizens remain unaware of the full impact of The World Bank on global economic systems and development policies. The institution’s significant influence on international finance, economic development, and poverty alleviation has not always been thoroughly understood or discussed in the public domain.

Evolving Awareness: Over time, as The World Bank and its policies have increasingly influenced global economics, there has been growing awareness of its role. However, comprehensive understanding of its historical context, decision-making processes, and long-term impacts is still not widespread among the general public.

Image from YouTube.com

While The World Bank was a pivotal institution established during the Bretton Woods Conference, the general public’s understanding of its full impact and the nuances of its formation remains limited. The decisions made at the conference were largely the domain of government officials and financial experts, with indirect influence from citizens and evolving public awareness over time.

Early Projects of The World Bank

In its initial years following World War II, The World Bank focused on a range of reconstruction and development projects to help rebuild war-torn Europe and foster economic growth in developing nations. Here are some of its first notable projects:

European Reconstruction:

Example: The first loan granted by The World Bank was to France in 1947 for the reconstruction of its devastated economy. This project was aimed at rebuilding infrastructure and supporting economic recovery in a country heavily impacted by the war.

Infrastructure Development:

Example: The World Bank provided funding for infrastructure projects such as roads, railways, and power plants. One of the early projects included financing a highway project in Colombia, which aimed to improve transportation and support economic development in the region.

Health and Education:

Example: The World Bank also supported projects in health and education, reflecting its commitment to improving living standards and human capital. Initial projects included funding for educational facilities and health infrastructure in various countries.

Funding Mechanisms

The World Bank’s initial funding came from several sources:

Capital Contributions:

Initial Capital: The World Bank was initially capitalized by contributions from its member countries. Each member was required to provide a certain amount of capital, which was used to finance its projects. The United States, as the largest contributor, played a significant role in the Bank’s initial capitalization.

Borrowing:

International Bonds: The World Bank raised additional funds by issuing bonds on the international capital markets. These bonds were sold to investors, providing the Bank with the necessary capital to fund its projects. The Bank’s strong credit rating, bolstered by the contributions of its member countries, helped it secure favorable borrowing terms.

Reinvestment:

Loan Repayments: As countries repaid their loans, The World Bank reinvested these funds into new “projects”. This cyclical process allowed the Bank to continue financing development initiatives over time.

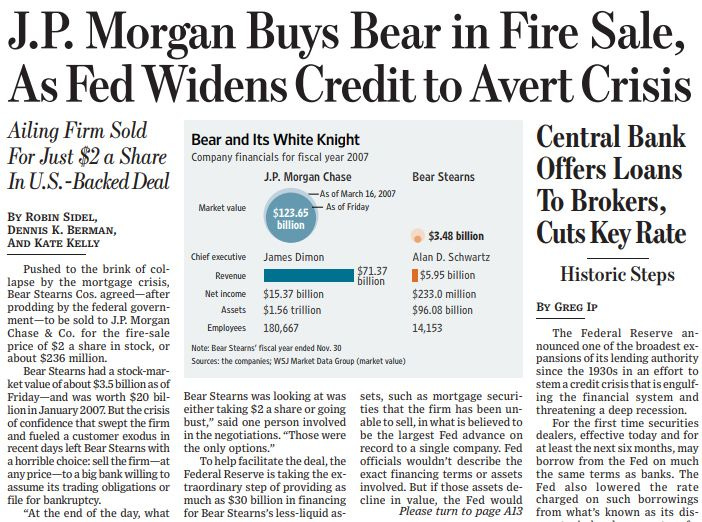

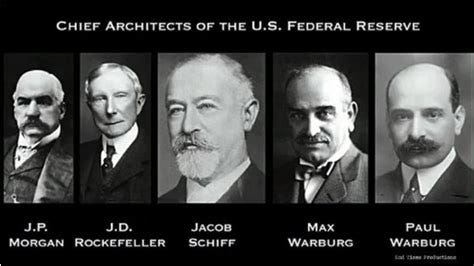

The Federal Reserve: The Banking Elites Behind Its Creation and Controversial Influence

The Federal Reserve, established in 1913 by the Federal Reserve Act, is the central banking system of the United States.

It was created to supposedly provide the country with a stable monetary and financial system, but it operates as a private institution with public oversight, often serving the interests of elite financial entities rather than the general public.

The Federal Reserve was established with significant influence from several major private banks and financial institutions including a few like:

J.P. Morgan & Co. (J.P. Morgan Chase)

Connection: The Morgan family has historically been linked with the Rothschilds through various banking alliances and partnerships. The Morgans and Rockefellers have collaborated extensively, solidifying their collective influence over U.S. economic policy.

Come again? Yes. That is correct. https://www.cbsnews.com/news/ship-seized-in-1-3-billion-cocaine-bust-is-owned-by-jp-morgan-chase/

National City Bank of New York (Citibank)

Connection: Citibank has had business dealings with the Rothschild banking empire and has been associated with the Rockefellers through various financial ventures and advisory roles. George Soros operates within the same high-finance circles and has collaborated with these families on various economic initiatives.

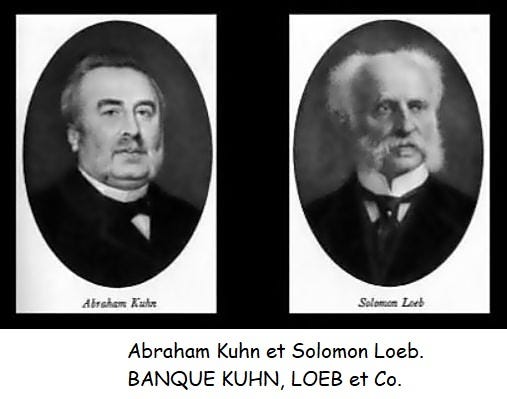

Kuhn, Loeb & Co.

Connection: This firm had strong ties to the Rothschild family. Senior partners, such as Jacob Schiff, were known for their alliances with both the Rothschilds and Rockefellers, influencing U.S. financial policies and supporting the creation of the Federal Reserve.

Lehman Brothers

Connection: Lehman Brothers had indirect connections with the Rothschilds through mutual business interests and financial collaborations. The Rockefellers’ influence in high finance also intersected with Lehman Brothers’ operations.

Goldman Sachs

Connection: Goldman Sachs has historical ties to both the Rothschilds and Rockefellers through partnerships, investments, and advisory roles. George Soros has worked with Goldman Sachs on various financial initiatives, reflecting their intertwined relationships within global finance.

Continental and Commercial Bank of Chicago

Connection: This bank had connections with both the Rothschilds and Rockefellers through various business dealings and financial collaborations, influencing the policies that led to the establishment of the Federal Reserve.

These and other financial entities and their elite connections have historically manipulated governments and economies to further their own agendas, often at the expense of public welfare.

Their involvement in the Federal Reserve has led to persistent criticisms of the institution as serving private interests over public good.

The Sinking of the Titanic: A Conspiracy?

A controversial theory suggests that the Titanic was deliberately sunk to eliminate wealthy individuals who opposed the creation of the Federal Reserve. Notable figures such as John Jacob Astor IV, Benjamin Guggenheim, and Isa Straus, who were opposed to the establishment of a central banking system, perished in the disaster. Proponents of this theory argue that the sinking cleared the way for the Federal Reserve’s creation, allowing the banking elites to consolidate their control over the U.S. financial system.

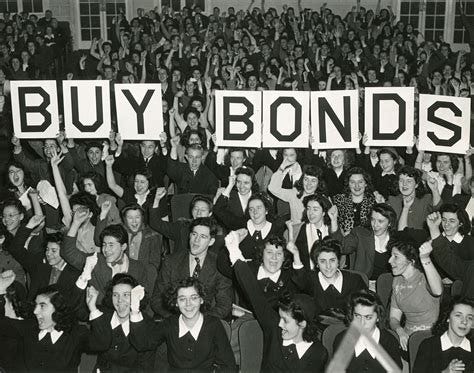

The Federal Reserve and War Bonds: Profiting from Conflict

During both World War I and World War II, war bonds were a significant financial instrument used by the U.S. government to raise funds for the war efforts. These bonds were essentially loans from citizens to the government, which promised to pay back the amount with interest after a certain period. The Federal Reserve and the major financial institutions connected to it played pivotal roles in the promotion and sale of these bonds.

How the Institutions Benefited:

Promotion and Sale of War Bonds:

The Federal Reserve and its member banks were instrumental in the distribution and sale of war bonds. They managed the logistics, marketing campaigns, and public outreach to ensure widespread purchase of these bonds. By facilitating these sales, they earned fees and commissions, directly profiting from the transactions.

Increased Influence and Power:

Managing the war bond program increased the influence and power of the Federal Reserve and the banks involved. Their central role in the war effort solidified their importance in the financial system, giving them greater leverage over U.S. monetary policy and economic planning.

Interest Payments and Financial Gains:

The bonds promised interest payments to investors. The Federal Reserve's policies, including setting interest rates, impacted the returns on these bonds. Banks and financial institutions holding significant amounts of war bonds profited from these interest payments.

Strengthening Government Ties:

By aiding the government in raising funds, these institutions strengthened their ties with policymakers. This relationship allowed them to influence post-war economic policies and decisions that would favor their interests.

Economic Stability and Growth:

The war effort and the sale of war bonds stimulated economic activity, leading to growth in various sectors. Banks and financial institutions benefited from this growth through increased deposits, loans, and financial services.

Profits from War Bonds

The financial institutions, including those connected to the Federal Reserve, profited significantly from their involvement in the war bond programs. Their central role in managing and selling the bonds not only earned them direct financial rewards but also enhanced their influence over the U.S. and global economies. These profits and the increased power they garnered have led to ongoing criticism and scrutiny regarding their motives and the true beneficiaries of their actions during these critical periods in history.

Influence and Impact

While the World Bank supposedly did not directly sell or profit from war bonds, the interconnectedness of global financial institutions ensured that the benefits of the war bond programs were felt across the board. The capital raised and the economic stability achieved through these bonds created a fertile ground for the World Bank's operations. Additionally, the involvement of major financial players in both the war bond programs and the establishment of the World Bank highlighted the continuity of influence and control exercised by these institutions.

Global Influence and Controversy

The Federal Reserve’s influence extends globally through its connections with international financial institutions like the United Nations and the World Bank. These entities promote economic policies that often align with the interests of elite financial networks. Curiously, the first President of the World Bank, Eugene Meyer, was also connected to the Federal Reserve, underscoring the interconnectedness of these powerful institutions. The creation and ongoing operations of the Federal Reserve have been marked by secrecy and controversy, with critics arguing that it undermines democratic governance and prioritizes the agendas of private bankers over those of the general public.

Selection of the World Bank President

The President of the World Bank Group is the head of the organization, responsible for overseeing the meetings of the boards of directors and managing the overall operations of the World Bank Group. The selection process typically begins with the President of the United States nominating a candidate, who is then reviewed by the U.S. administration to ensure they meet the necessary qualifications and align with U.S. economic and foreign policy goals. Once nominated, the candidate is presented to the World Bank's Board of Executive Directors for confirmation. The nominee must be approved by the Board to serve a five-year term, which can be renewed. Traditionally, this position has always been filled by an American citizen, reflecting the significant influence the United States holds as the Bank's largest shareholder. This practice has led to calls for a more transparent and inclusive selection process that considers candidates from a broader range of member countries.

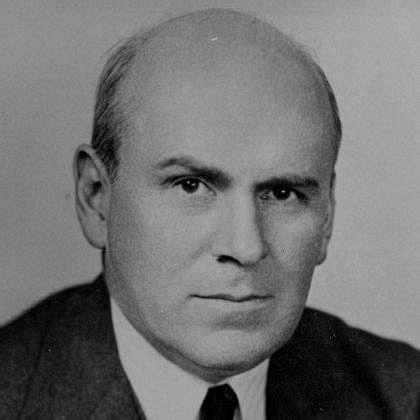

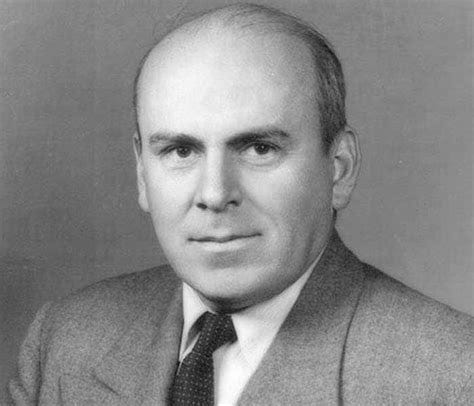

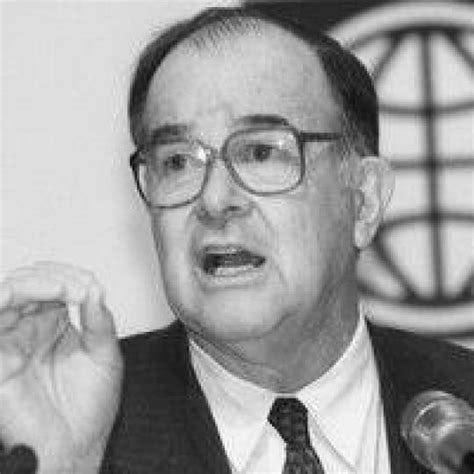

Eugene Meyer: First President of The World Bank (Term at the World Bank June 18, 1946 – December 18, 1946)

Background and Appointment

Background:

Eugene Meyer (October 31, 1875 – July 17, 1959) was an American financier and government official with a background in banking and public service. Before becoming the President of The World Bank, Meyer had a distinguished career as a banker and public servant. He served as the chairman of the Federal Reserve Board from 1930 to 1933 and was known for his expertise in finance and economic policy. Eugene Meyer and Harry S. Truman had a close working relationship, with Meyer’s extensive experience and reputation in finance leading to his nomination as the first President of the World Bank in 1946. Their connection was strengthened by Meyer’s prior roles as Chairman of the Federal Reserve Board and a member of the Federal Reserve Board, which aligned with Truman’s post-war economic strategies and goals.

He also bought the Washington Post. He acquired the newspaper at a bankruptcy auction in 1933. Meyer, who had previously served as the 5th Chairman of the Federal Reserve, bought the Washington Post for $825,000. Under his ownership and later his family's stewardship, the Washington Post grew in prominence and became one of the leading newspapers in the United States.

Image from https://ebrary.net/14934/economics/president

Appointment:

Selection Process: Eugene Meyer was appointed as the first President of The World Bank in 1946. His appointment was influenced by his extensive experience in finance and his role in shaping U.S. economic policy during the Great Depression. Meyer was supposedly chosen for his strong leadership skills and his ability to navigate the complexities of international finance.

Role and Contributions:

As the first President, Meyer played a crucial role in establishing The World Bank’s operational framework and initiating its early projects. His leadership helped set the stage for the Bank’s development and its role in global economic reconstruction.

John J. McCloy: The Second President of the World Bank (Term at the World Bank March 17, 1947 – June 30, 1949)

John J. McCloy (March 31, 1895 – March 11, 1989), who served as the second President of the World Bank from 1947 to 1949, was a figure of considerable influence whose career was marked by both achievements and controversies.

John J. McCloy: A few Key Roles and Positions Timeline to Keep in Mind

1939: Joined the Council on Foreign Relations (CFR).

1941-1945: Served as Assistant Secretary of War.

1947-1949: President of the World Bank.

1949-1952: U.S. High Commissioner for Germany.

1953-1960: Chairman of Chase Manhattan Bank.

1953-1970: Chairman of the CFR's Board of Directors.

1958-1960: Chairman of the Ford Foundation.

1970: Became Honorary Chairman of the CFR.

Early Career and Legal Background

John J. McCloy’s early career saw him enrolled at Harvard Law School in 1916, where his academic performance was average. His experience at the Plattsburg Preparedness camps profoundly influenced him, and he joined the U.S. Army in May 1917, quickly rising to the rank of second lieutenant in the Artillery. He served in France with the American Expeditionary Forces, seeing combat during the Meuse–Argonne offensive. After the war, he was stationed at General Headquarters in Chaumont and Trier, Germany, before returning to the U.S. in 1919 to complete his LL.B. at Harvard.

Hebegan his legal career after returning from military service in 1919, joining the firm Cadwalader, Wickersham & Taft. He gained prominence as a name partner at the prestigious New York law firm Milbank, Tweed, Hadley & McCloy from 1945 to 1947 and then continued as a general partner for 27 years, until his death in 1989. During this period, he maintained strong ties to the Rockefeller family, serving as a trustee of the Rockefeller Foundation from 1946 to 1949 and as chairman of the Ford Foundation from 1958 to 1965.

Involvement in the Council on Foreign Relations

John McCloy was deeply embedded in the Council on Foreign Relations (CFR), an organization founded in 1921 that has often been criticized for its significant, behind-the-scenes influence on U.S. foreign policy. McCloy was actively involved with the CFR from the 1940s through the 1970s, during which he played a key role in shaping the organization's direction and influence. The CFR is known for its exclusive membership, comprising “elites” from business, politics, and academia, who meet to steer American international affairs in ways that often benefit globalist agendas. McCloy’s participation in the CFR placed him at the heart of this powerful group, allowing him to contribute to decisions that impacted global policies. His involvement highlights his deep connections to the shadowy networks accused of driving U.S. foreign policy without transparency or accountability to the public.

In recognition of his long-standing influence, the CFR established the John J. McCloy Program on International Relations, created in 1985, funds activities at the CFR focused on areas of deep interest to McCloy. This program includes the John J. McCloy Roundtable on Setting the National Security Agenda, a series launched in 1996 that aims to identify and highlight emerging national security issues deserving further exploration by the CFR.

McCloy gained prominence for reopening a case against Germany for the Black Tom explosion—a supposed sabotage attack that had severely disrupted Allied munitions supplies.

During the 1930s, he also advised major German corporations, including I.G. Farben, a chemical giant that later produced Zyklon B gas used in Nazi extermination camps. McCloy’s involvement with I.G. Farben and other German firms during this period highlighted his deep entanglement in complex legal and corporate issues linked to Nazi Germany.

Military Service

During World War II, McCloy held the position of Assistant to the Secretary of War, Robert P. Patterson. His involvement in the internment of Japanese-Americans remains a dark and controversial aspect of his legacy, as this policy is now widely condemned as a severe injustice.

The Origins and Development of the U.S. Biological Weapons Program in the 1940s

In the early 1940s, the United States began developing a significant biological weapons (BW) program due to intelligence suggesting that Germany had its own BW initiative. This intelligence was later proven incorrect after World War II ended. The U.S. BW program included both offensive and defensive components from the outset, with Secretary of War Henry Stimson advocating that a strong defense required the capability to retaliate in kind.

Initially, the BW program was managed by the War Research Service (WRS), a committee linked to the Federal Security Agency. George Merck, president of the pharmaceutical company Merck & Co., was appointed to lead the WRS, overseeing the entire program. In January 1944, the WRS was disbanded, and the Chemical Warfare Service (CWS) assumed control of all BW-related research and production, while the Army Surgeon General was tasked with defensive measures.

A memo to the Secretary of War in September 1945 highlighted the program's supposed biological achievements, including the mass production of pathogens like Bacillus anthracis (anthrax) and Brucella melitensis (brucellosis) at pilot plants, the development and field testing of a new cluster bomb, and the construction of facilities for large-scale production of various pathogens (more like chemical weapons that they don’t like to talk about), including anti-crop agents. Most BW-related research and development occurred at Camp (later Fort) Detrick in Maryland, under George Merck's leadership.

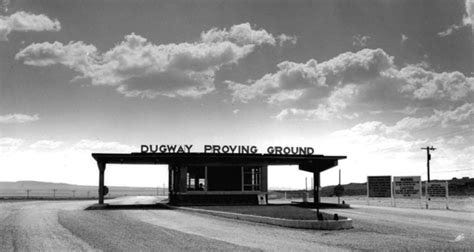

Whatever weapons that were made at Detrick were sent to Dugway Proving Grounds in Utah for open-air testing. Biological weapons that were successfully tested and proven effective, such as bomblets, bombs, and spray systems, were mass-produced at manufacturing plants located at the Pine Bluff Arsenal in Arkansas. The U.S. invested over $40 million in these facilities and equipment between 1942 and March 1945. By the war's end, around 4,000 people were involved in the program.

Establishing a Wartime Security Structure

An indefatigable committee member, John McCloy played a pivotal role during the war by participating in government task forces that constructed the Pentagon and established the Office of Strategic Services, the precursor to the Central Intelligence Agency. He also proposed the creation of both the United Nations and the war crimes tribunals. Additionally, he chaired the forerunner to the National Security Council.

Architect of American Intelligence Operations

John McCloy, a pivotal figure in American intelligence, played a crucial role in the development of the Office of Strategic Services (OSS), which later evolved into several key agencies, including the Central Intelligence Agency (CIA), the National Security Agency (NSA), and the Defense Intelligence Agency (DIA).

In the early 1940s, Secretary of War Henry Stimson tasked McCloy with resolving the political tensions within the pre-war intelligence community, plagued by infighting and jurisdictional disputes among the Army, Navy, and FBI director J. Edgar Hoover. To address this, McCloy collaborated with William "Wild Bill" Donovan to create the OSS, a new intelligence program designed to merge and streamline these efforts, modeled after British intelligence agencies.

McCloy’s advocacy was instrumental in the establishment of the OSS. As an influential lawyer and later the Assistant Secretary of War during World War II, he was a strong proponent for a centralized intelligence agency to coordinate espionage and covert operations. His influential position within the War Department allowed him to push for this initiative, ensuring that the United States had a robust intelligence apparatus to combat perceived global “threats”.

The OSS was short-lived. On September 20, 1945, President Truman signed Executive Order 9621, terminating the OSS. Due to an administrative error, the agency had only ten days to close. The State Department took over the Research and Analysis Branch, which became the Bureau of Intelligence and Research. The War Department took over the Secret Intelligence and Counter-Espionage Branches, housing them in the new Strategic Services Unit (SSU). Brigadier General John Magruder, formerly Donovan's Deputy Director for Intelligence, became the SSU director, overseeing the liquidation of the OSS and preserving its clandestine intelligence capabilities. This centralization of war intelligence served as a blueprint for the establishment of the Central Intelligence Agency under the National Security Act of 1947.

In January 1946, President Truman created the Central Intelligence Group (CIG), the direct precursor to the CIA. SSU assets were transferred to the CIG in mid-1946 and reconstituted as the Office of Special Operations (OSO). The National Security Act of 1947 established the CIA, which then took up some OSS functions. The direct descendant of the paramilitary component of the OSS is the CIA Special Activities Division. Today, the joint-branch United States Special Operations Command, founded in 1987, uses the same spearhead design on its insignia as homage to its indirect lineage. The Defense Intelligence Agency currently manages the OSS' mandate to provide strategic military intelligence to the Joint Chiefs of Staff and the Secretary of Defense and to coordinate human espionage activities across the United States Armed Forces through the Defense Clandestine Service.

Beyond his role in the OSS and the creation of the CIA, McCloy was influential in the broader context of American intelligence and national security. His contributions laid the groundwork for various clandestine projects that emerged in the intelligence community. While there is no direct evidence (that they haven’t destroyed or hidden) linking McCloy to specific programs like MKUltra, MKNaomi, or the Tuskegee Experiment, his influence and foundational work in establishing the intelligence infrastructure made these controversial projects possible.

MKUltra, which began in the early 1950s, involved mind control and behavioral modification experiments, often conducted without the consent or knowledge of the subjects. MKNaomi, one of at least 149 MK Ultra subprojects, a project associated with biological warfare, similarly operated in secrecy. The Tuskegee Experiment, which ran from 1932 to 1972, saw the unethical treatment of African American men in supposed syphilis studies, without their informed consent. The true extent of what was done to those individuals remains uncertain.

Numerous unethical studies were conducted during this period, many of which appeared to be linked to developing various chemical weapons. Interestingly, antibiotics were introduced around the same time and hailed as revolutionary treatments. However, one might question whether they could have been derived from the many unethical experiments conducted during this era. And are they really good?

McCloy was one of a select group of Franklin D. Roosevelt's trusted advisers who were privy to the Manhattan Project, the top-secret initiative to develop the atomic bomb during World War II. This position placed him at the heart of critical wartime decisions and technological advancements, further solidifying his influence on American intelligence and defense strategies.

Post-War Roles in Germany

Following the end of World War II, McCloy played a pivotal role in the Allied occupation of Germany. He was appointed as the U.S. High Commissioner for Germany, a position he held from 1949 to 1952. As High Commissioner, McCloy was responsible for overseeing the economic and political reconstruction of Germany. He was instrumental in shaping the new democratic framework of West Germany and played a key role in the implementation of policies aimed at stabilizing the German economy and integrating Germany into the Western bloc. His influence in Germany extended to promoting economic recovery and managing the transition from military occupation to civilian rule.

As U.S. High Commissioner for Germany from September 1949 to August 1952, McCloy also granted pardons to prominent Nazi war criminals, including industrialists Friedrich Flick and Alfried Krupp, who had their confiscated property restored. He also commuted the sentences of Martin Sandberger, an SS/SD commander involved in the extermination of Jews, communists, Roma, and the mentally ill, as well as three high-ranking Nazis responsible for the murder of 84 American POWs. Could McCloy have been involved in recruiting the Nazi scientists involved in Operation Paperclip? His curriculum vitae suggests that it’s likely, but given the secrecy surrounding these operations and the lack of accessible documentation, we might never be certain.

Nomination to the World Bank Presidency

In 1947, President Harry S. Truman nominated McCloy to become President of the World Bank. Truman’s decision was influenced by McCloy’s extensive experience in finance, law, and his elite connections. McCloy’s nomination was a reflection of his high standing in influential circles, although his background also raised concerns among some critics.

Presidency at the World Bank

During his presidency, McCloy contributed to the early development of the World Bank. His tenure was characterized by efforts to establish the institution's framework and policies, leveraging his financial and legal expertise. However, his role also emphasized the significant influence of elite networks in shaping international finance.

Political Involvement

President Dwight D. Eisenhower considered McCloy for the Chief Justice position in 1953, but his close ties to big business and financial elites led to his non-appointment.

The Salk Institute and John McCloy's Role

Throughout various periods, McCloy held multiple prominent positions simultaneously. He served as the chairman of the Ford Foundation, led the influential Council on Foreign Relations, and chaired over twelve other organizations, including the Salk Institute.

The Salk Institute was established in 1960 by Jonas Salk, the developer of the polio vaccine, to focus on basic and applied biomedical research. The institute was designed to be a leading center for scientific investigation and innovation in health and disease. John McCloy was involved with the Salk Institute from its early years, serving as chairman of its board of trustees. His role was crucial in shaping the Institute's strategic direction and ensuring its success. However, detailed records of his specific contributions and actions during this period are notably sparse, making it difficult to fully assess his influence and the extent of his involvement.

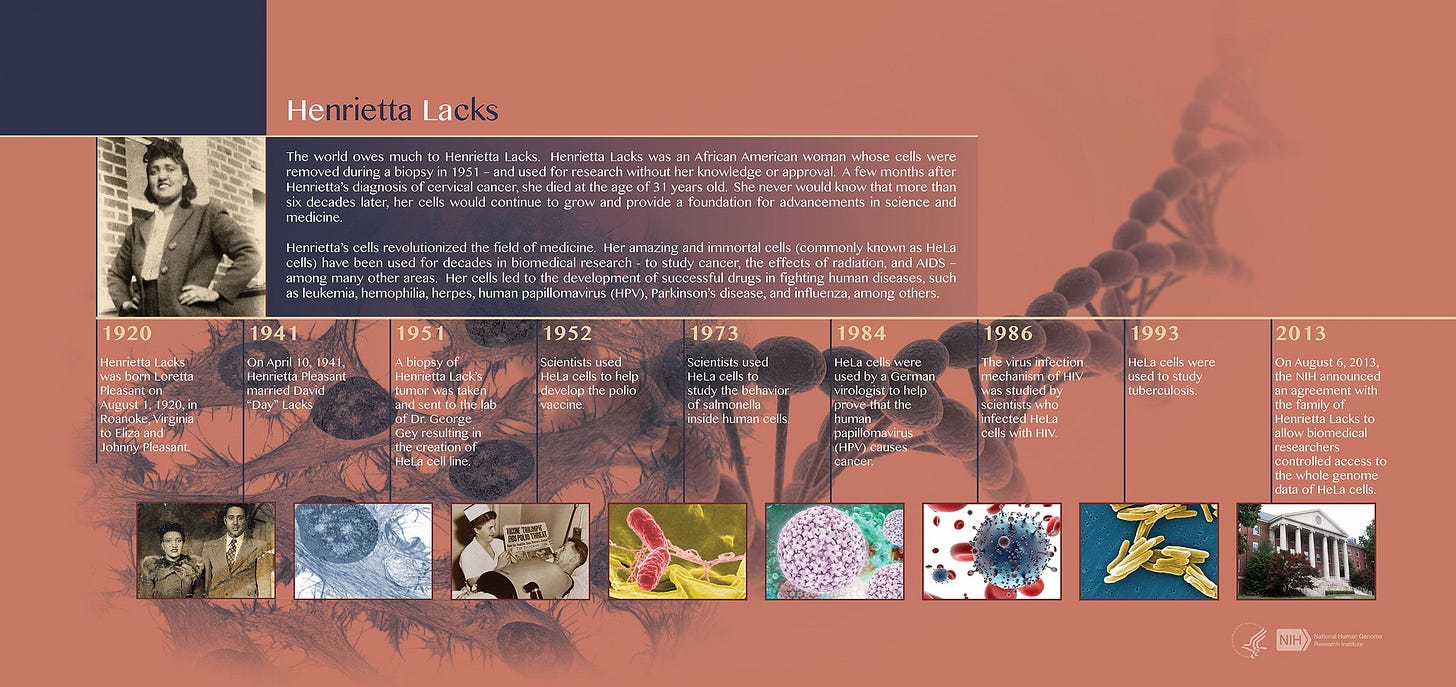

The Salk Institute’s contributions include extensive work with HeLa cells, a crucial tool in medical research. These cells, derived from Henrietta Lacks' cancer cells, have been fundamental in developing vaccines and other medical treatments. Under McCloy's stewardship, the Salk Institute cemented its position as a key player in the vaccine industry, influencing the trajectory of modern biomedical research.

One of the intriguing aspects of the early science of human cell culture involves the Tuskegee Institute's role in the development and testing of the Salk Polio vaccine. HeLa cells, derived from Henrietta Lacks, proved crucial in this process. In April 1952, scientists George Gey and William Scherer discovered that HeLa cells were supposedly highly susceptible to the poliovirus, making them ideal for widespread vaccine testing. The National Foundation for Infantile Paralysis (NFIP), now known as the March of Dimes, recognized the potential of HeLa cells and contracted Scherer to oversee the establishment of the first HeLa Distribution Center at the Tuskegee Institute. This center marked the beginning of cell-production factories, starting with a single vial of HeLa cells sent by Gey. These cells were utilized to test the immunogenicity of the polio vaccine by determining if it could protect HeLa cells from poliovirus infection.

The Tuskegee Institute's involvement in this scientific breakthrough is notable, particularly when contrasted with its infamous role in the Tuskegee Syphilis Study. The study, which lasted from 1932 to 1972, infamously withheld treatment from African American men with supposed syphilis to observe the disease's progression. But who knows what really transpired with any of it really?

Despite this dark chapter, the Tuskegee Institute also served as a site where African American scientists and technicians contributed significantly to medical advancements, including the polio vaccine development. The question arises about the authenticity of historical narratives and scientific claims. Given that much documentation related to these experiments is either classified, destroyed, or hidden from public scrutiny, it remains uncertain whether diseases like syphilis truly existed as reported, or what the full extent and intent of these experiments were. This is particularly significant since the Tuskegee Experiment is directly connected to the creation of vaccines, making it crucial to examine the transparency and integrity of historical scientific practices and their lasting impacts.

The rollout of vaccines developed through the research at the Salk Institute were marred by significant issues. For instance, early versions of the polio vaccine, which was initially celebrated as a breakthrough, were later linked to cases of vaccine-associated paralytic poliomyelitis (VAPP) and other adverse effects.

During the early 1950s, when the polio vaccine was first introduced, there were reports of around 200 cases of VAPP, which led to temporary vaccine-related paralysis in a number of individuals.

Recent evidence indicates that the foundational germ theory, which underpins much of vaccine development, is a total fraud. Critics argue that the theory is fundamentally flawed and that vaccines could be more harmful than beneficial. This view posits that vaccines may not only fail to provide the promised benefits but could also contribute to various health issues. This perspective raises questions about the true intent behind vaccine development, especially when funded and supported by individuals linked to globalist agendas. It suggests that these efforts might be driven by motives other than public health, including control, profit, and population control.

Given McCloy's extensive roles in influential organizations and his position at the Salk Institute, it presents a complex and troubling picture. While his leadership roles suggest a commitment to advancing public welfare and scientific progress, the growing body of evidence questioning the efficacy of germ theory and highlighting potential vaccine harms introduces an unsettling dimension. This complexity invites further scrutiny of how these influential positions interrelate and what they reveal about the broader motivations and impacts of vaccine development, particularly in the context of globalist interests and potential hidden agendas.

Shaping NATO Policy

John McCloy played a significant role in shaping NATO policy during Lyndon B. Johnson's presidency from 1963 to 1969. As a trusted confidant and influential figure in international diplomacy, McCloy leveraged his extensive experience to guide Johnson’s approach to the North Atlantic Treaty Organization. His involvement was instrumental in strengthening NATO's strategic positioning and reinforcing the alliance's collective security commitments. However, this close collaboration between McCloy and Johnson also raised concerns about the undue influence of financial elites on global security policies. Critics argue that McCloy’s financial interests and connections may have skewed policy decisions, prioritizing corporate and geopolitical gains over broader democratic accountability and the genuine needs of the alliance. This interplay between high-level financial acumen and government policy highlights the potential dangers of concentrated influence in shaping international affairs, particularly in a period marked by significant geopolitical tension.

Warren Commission and Later Roles

In 1963, McCloy was appointed to the Warren Commission by President Lyndon Johnson to investigate President John F. Kennedy’s assassination.

Although supposedly initially skeptical, McCloy was convinced of the lone gunman theory, partly due to his discussions with CIA veteran Allen Dulles. His influence in shaping the commission's final report, which dismissed conspiracy theories and concluded that evidence was beyond the reach of U.S. agencies, has been widely criticized. Critics argue that McCloy's elite connections may have influenced the commission’s findings. While participating in the official investigation into President John F. Kennedy's assassination, for whom McCloy had previously worked as the chief disarmament negotiator, he remarked that evidence of a conspiracy was "beyond the reach" of both the FBI and CIA.

McCloy was also approached by President Johnson in 1967 for the role of U.S. Ambassador to the United Nations but declined the offer.

Return to Law and Legacy

After his World Bank presidency, McCloy returned to Milbank, Tweed, Hadley & McCloy. His work at the firm was marked by high-profile legal battles, including representing the "Seven Sisters" — the major multinational oil companies such as Exxon — during their confrontations with the nationalization movements in Libya and negotiations with Saudi Arabia and OPEC. McCloy’s involvement in these high-stakes negotiations and his connections with the Rockefellers and other elite figures earned him the moniker "Chairman of the American Establishment."

Upon John McCloy's death, President George Bush, whose grandfather Prescott Bush who had banking ties with Hitler and the Nazi regime, issued a heartfelt statement commemorating the passing of John J. McCloy. This raises questions about how interconnected these individuals were with one another and with Nazi Germany.

George Bush

41st President of the United States: 1989 ‐ 1993

Statement on the Death of John J. McCloy

March 21, 1989

Barbara and I extend our sincere condolences to the family and many friends of John J. McCloy. We share your loss. The American people join you in mourning the passing of one of the giants and true heroes of this country.

John J. McCloy helped shape American policy and perspectives during the past fifty years -- in public service and in private life -- as few others have. He was a trusted adviser of American Presidents from Franklin D. Roosevelt to Ronald Reagan. I shall miss the privilege of his counsel. But he also never flagged in pursuing the public good in the many private trusts he held. His energy and interests were boundless. So were his accomplishments.

Recalling his work as chairman of the Ford Foundation, of the Council of Foreign Relations, of the Salk foundation, of the Fund for Modern Courts in New York State, and of the American Council on Germany -- to name but a few of his responsibilities -- one cannot but stand in awe of this great man of humble origins. Not only his talents and experience, but also his dedication and sense of fair play, were rare indeed. We are poorer for his passing. But we as a country are so much richer for having had him with us for 93 years.

John J. McCloy was not only a prominent American, but also a citizen of the world. He served as President of the World Bank at a crucial time in that institution's history. In later years he became intensely involved with the United Nations Development Corporation.

He was also a pioneer in the field of arms control. In addition to being President Kennedy's chief disarmament adviser and negotiator, John J. McCloy served for a dozen years as Chairman of the General Advisory Committee on Disarmament Agency. His aim -- which now is the long-established position of the West as well as part of the declared "new thinking" in the East -- was to establish security at lower levels of armament.

But perhaps John J. McCloy's greatest mark was left by his service in Germany. I know he believed it was among the most important of his assignments. As the United States Military Governor and then High Commissioner from 1949 to 1953, John J. McCloy helped rebuild the economic structure of a nation in rubble, directly touching and assisting millions of Germans living in a country devastated by war. In perhaps his most lasting contribution, he helped establish the democratic tradition of the Federal Republic of Germany and the unbreakable bonds of friendship and solidarity between the German and American peoples.

As Chancellor Helmut Kohl has written of John J. McCloy: "He deserves much of the credit for the high quality of German-American relations which we today take for granted, but which at that time only a trusting friend of our people like John McCloy could see as an objective worth pursuing."

Friend of Germany, friend of Europe, friend of peace, America's friend to the world: John McCloy is a friend who will be missed.

George Bush, Statement on the Death of John J. McCloy Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/247628

McCloy's legacy is marred by his association with elite interests and controversial policies and the military and intelligence agencies. His role in facilitating the interests of powerful multinational corporations and his contributions to policies that benefitted the elite emphasizes a career characterized by privilege and influence, often at the expense of broader justice and fairness. His long tenure in the legal world and influential roles reflect a career intertwined with the interests of the powerful, sometimes prioritizing those interests over broader societal concerns.

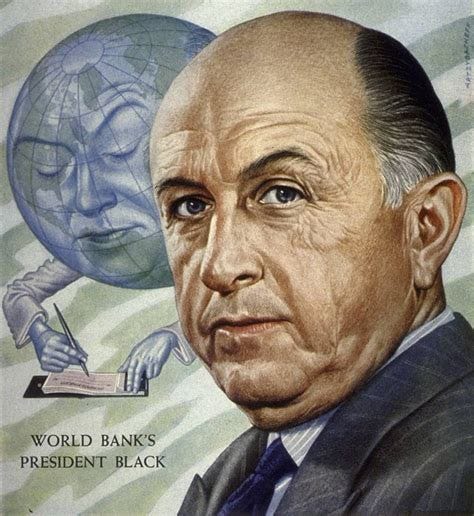

Eugene Robert Black Sr.: The Third President of the World Bank (Term at the World Bank July 1, 1949 – December 31, 1962)

Eugene Robert Black Sr. (May 1, 1898 – February 20, 1992) served as the third President of the World Bank from 1949 to 1962. Nominated by his predecessor, John J. McCloy, Black's leadership was pivotal during a formative period for the institution.

Background and Early Career

Born in Atlanta, Georgia, Black attended the University of Georgia, where he was a member of the Chi Phi Fraternity and the Phi Kappa Literary Society. After graduating with an A.B. in 1917, he served in the U.S. Navy during World War I, working on convoy duty in the North Atlantic. Upon leaving the Navy, Black joined the investment firm Harris, Forbes & Co., an investment banking affiliate of Harris Bank incorporated in 1911, where he became a partner and established the firm's first southern office in Atlanta. He worked as a traveling representative for the firm, selling bonds and engaging with bankers and investors. He established the firm's first southern office in Atlanta and eventually became a partner.

Harris, Forbes firm was acquired by Chase National Bank in 1930 to form Chase Harris, Forbes. In 1933, Black was hired by Chase National Bank, where he advanced to senior vice president, overseeing the bank's investment portfolio.

World Bank Presidency

Black became Executive Director of the World Bank in 1947. Following John J. McCloy's resignation in 1949, Black assumed the presidency. Although initially reluctant, Black’s dedication to the World Bank’s mission led him to stay on despite his desire to return to Chase National. His tenure was marked by his commitment to promoting economic prosperity as a means to achieve political freedom, earning the institution the nickname "Black's Bank."

Post-World Bank Career

In 1963, Black and Stanley Osborne led a commission to review the feasibility of a U.S. supersonic transport program. Their report recommended focusing on research rather than competing directly with the Concorde.

Black also chaired the Brookings Institution, a prominent think tank known for its in-depth research and policy analysis, from 1962 to 1968.

He was appointed by President Johnson as Special Adviser on Southeast Asian Social and Economic Development in 1966. In this role, Black was instrumental in establishing the Asian Development Bank, a key component of U.S. efforts to gain support for the Vietnam War.

Black's influence extended to various boards, including:

Brookings Institution: Chairman from 1962 to 1968, overseeing policy research and analysis.

Peabody Awards: Chair of the Board of Jurors from 1967 to 1977.

He was honored by the University of Georgia Foundation with a named fellowship and received an honorary Doctor of Laws degree from Princeton University in 1960. Despite some controversies, Black's legacy in global development and finance remains significant.

George David Woods: The Fourth President of the World Bank (Term at the World Bank January 1, 1963 – March 31, 1968)

George David Woods (July 27, 1901 – August 20, 1982) served as the fourth President of the World Bank from January 1963 to March 1968, nominated by his predecessor, Eugene Robert Black Sr. Black, who had led the institution from 1949 to 1962, selected Woods for his extensive experience and expertise in the banking sector. Woods’ impressive career trajectory, from starting as an office boy to becoming chairman of the board at First Boston Corporation, demonstrated his deep understanding of finance and investment. Black believed that Woods' background in economic analysis and his commitment to addressing global economic disparities made him the ideal candidate to lead the World Bank through a period of transformation and expansion.

Early Career and Rise in Banking

Born in Boston, Massachusetts, Woods started his career as an office boy at the underwriting firm Harris, Forbes & Co. Encouraged by the company, he attended night school to study banking. His diligence paid off, and by 26, he had been promoted to vice president. In 1930, after Harris, Forbes & Co. was acquired by Chase Bank, Woods became vice president of the new entity. He later joined First Boston Corporation, a prominent securities company, where he ascended to the roles of executive vice president, chairman of the executive committee, and eventually chairman of the board.

World Bank Presidency

Woods' tenure at the World Bank was characterized by a shift towards a more global perspective, emphasizing the correction of economic disparities between wealthy and poor nations. He prioritized economic analysis to understand the underlying causes of limited growth in developing countries, moving away from simply assessing creditworthiness.

One of his notable achievements was the establishment of the International Centre for Settlement of Investment Disputes (ICSID), which provided reassurance to private investors wary of investing in developing nations. Woods also led the World Bank during a critical period of assistance to India, which included the controversial devaluation of the rupee in 1966.

Controversies:

Rupee Devaluation: The World Bank's involvement in the devaluation of the Indian rupee in 1966 was met with significant controversy. Critics argued that this move exacerbated inflation and economic instability in India.

Focus on Economic Disparities: While Woods’ efforts to address economic disparities were well-intentioned, some critics felt that the implementation of these policies sometimes overlooked the unique socio-political contexts of developing nations, leading to mixed results.

Global Influence: Woods’ tenure saw the World Bank exerting more influence over the economic policies of sovereign nations, sparking debates over the institution's role in global governance and its impact on national sovereignty.

Military and Honors

While there is no direct evidence of Woods' involvement in military activities, his leadership in international financial matters often intersected with global political dynamics, especially during the Cold War era. In recognition of his contributions, he was awarded the honorary title of Grand Commander of the Order of Loyalty to the Crown of Malaysia in 1973.

Legacy

George David Woods left an indelible mark on the World Bank, steering it towards a more analytical and globally integrated approach to economic development. His tenure is remembered for both its ambitious goals and the controversies that accompanied his “efforts” to “bridge the gap” between rich and poor nations.

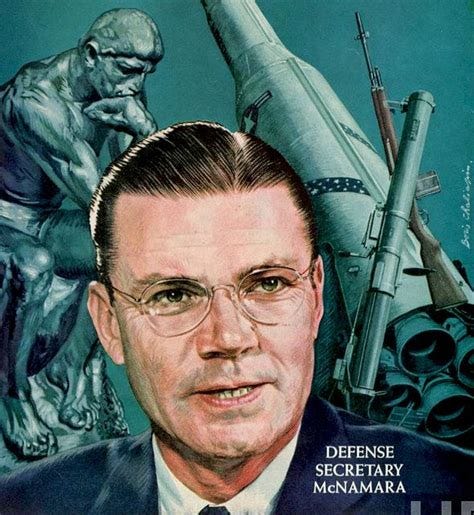

Robert S. McNamara: Fifth World Bank President (Term at the World Bank April 1, 1968 – June 30, 1981)

Robert Strange McNamara (June 9, 1916 – July 6, 2009), known for his controversial tenure as the fifth President of the World Bank from 1968 to 1981, was a figure who stirred strong opinions wherever he went. Nominated by President Lyndon B. Johnson, McNamara's path to the World Bank was shadowed by a contentious history as the longest-serving U.S. Secretary of Defense under Presidents John F. Kennedy and Lyndon B. Johnson, particularly noted for his pivotal role in escalating the Vietnam War. Special Counsel Ted Sorensen noted that Kennedy considered McNamara the "star of his team," frequently seeking his advice on various matters beyond national security, including business and economic issues. McNamara was one of the few in the Kennedy Administration who both worked and socialized with Kennedy. He also grew close to Attorney General Robert F. Kennedy and served as a pallbearer at his funeral in 1968.

Born in San Francisco, McNamara's sharp mind led him from the University of California, Berkeley to Harvard Business School. During World War II, he served in the United States Army Air Forces, where he became known for his statistical analysis of bombing efficiency—a precursor to his cold, calculative approach in later roles.

Post-war, McNamara joined Ford Motor Company as part of the "Whiz Kids," a group that brought modern management techniques to the struggling automaker. His rapid rise to president of Ford was marked by an aggressive, no-nonsense style that won him few friends but delivered results.

As Secretary of Defense, McNamara's tenure was marked by the controversial application of systems analysis to military strategy. He was a driving force behind the U.S. involvement in Vietnam, advocating for policies that led to a significant escalation of the conflict. Despite his eventual doubts about the war, his role in its expansion left an indelible mark on his legacy, casting a long shadow over his subsequent career.

At the World Bank, McNamara shifted the institution's focus from grand infrastructure projects to “poverty reduction”, an agenda that, while seemingly noble, was often criticized for being out of touch with on-the-ground realities and for promoting Western-centric solutions to complex global problems.

McNamara tenure was seen by many as heavy-handed and technocratic, characterized by a top-down approach that mirrored his earlier career in government and business.

After stepping down from the World Bank, McNamara continued to be a polarizing figure, often reflecting on his past decisions with a mix of regret and justification. His legacy is a complex one, marked by significant achievements but overshadowed by the profound controversies that defined his public life.

Nuclear Strategy and Triad Doctrine

When McNamara took over as Secretary of Defense in 1961, he faced a military strategy centered on an all-out nuclear strike in response to any Soviet attack, a plan devised by the Strategic Air Command under General Curtis LeMay. McNamara sought alternatives, recognizing that this approach risked leaving the U.S. vulnerable to Soviet retaliation. He educated NATO on the doctrine of deterrence and introduced the counterforce strategy, aiming to target only enemy military forces to limit nuclear exchanges. However, he soon realized this would likely provoke retaliation rather than control escalation. Consequently, the U.S. nuclear policy remained unchanged.

Heightened Alert

McNamara increased the number of Strategic Air Command bombers on 15-minute alert from 25% to 50%, reducing their vulnerability to missile attacks. He also initiated Operation Chrome Dome, maintaining B-52 bombers armed with thermonuclear weapons on continuous airborne alert, ready to strike Soviet targets if ordered. This program led to several nuclear weapon accidents, known as Broken Arrow incidents.

Anti-Ballistic Missile (ABM) System

Near the end of his term, McNamara opposed deploying an ABM system in the U.S., citing its questionable effectiveness against a Soviet missile attack. Under pressure, he agreed to a minimal system intended to protect against a smaller number of Chinese missiles. He believed relying too heavily on nuclear defenses posed psychological risks and preferred maintaining a balance of mutual assured destruction (MAD) with the Soviet Union.

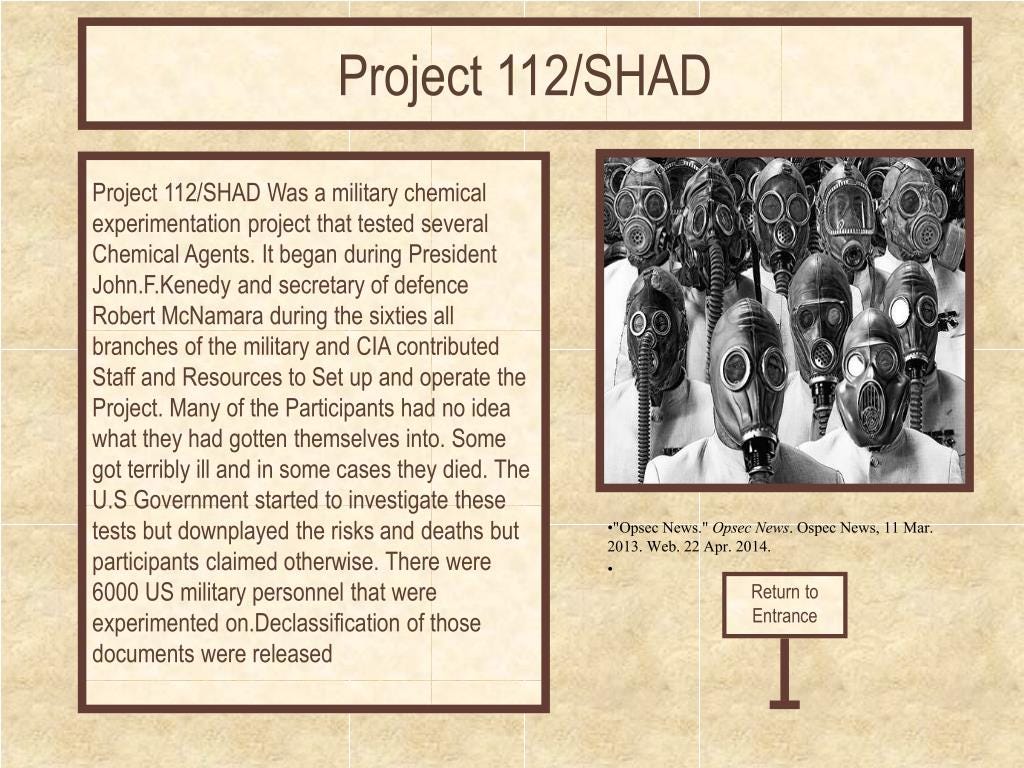

Chemical and Biological Warfare Experiments

Robert McNamara authorized Project 112 (along with the related Project SHAD), involving biological and chemical weapon experiments. Project 112 was a U.S. Department of Defense program for biological and chemical weapon testing from 1962 to 1973 (about the same time that MK Ultra and their subprojects like MK Naomi took place out of Fort Dietrich as well as the Tuskegee Experiment in the South).

Initiated under President Kennedy and authorized by Secretary of Defense Robert McNamara, Project 112 aimed to evaluate the U.S. military's capabilities and involved contributions from all branches of the armed services, intelligence agencies, and international partners, including Canada and the UK. The project focused on dispersing biological and chemical agents to cause "controlled temporary incapacitation" and conducted tests in the Central and South Pacific, Alaska, and other locations.

At least 50 trials were conducted (but 150 projects are publicly listed but many were supposedly cancelled), using both simulants and actual agents such as sarin, VX, and tear gas, and a highly classified agent referred to as Tiara (a “luminescent gelatinous material” with no further information available on this substance.). Testing sites included multiple locations throughout the United States, Porton Down (UK), Ralston (Canada), and various U.S. warships under Project SHAD (Shipboard Hazard and Defense). Project 112 was managed from the Deseret Test Center in Utah.

In Yeehaw, Florida, Project 112 involved the deliberate spraying of wheat rust as part of a covert military experiment. Conducted during the 1960s, this operation was designed to test the dispersal and impact of agents on agriculture, with the purported aim of using such agents to destroy enemy crops. The use of wheat rust in this project raised significant ethical concerns, as it targeted crops in an area where the potential consequences for local agriculture and the environment were not fully disclosed to the public.

Public knowledge of Project 112 remained limited until a CBS report in 2000 revealed its existence, prompting investigations by the Department of Defense and the Department of Veterans Affairs. Congressional hearings and lawsuits followed, addressing the lack of informed consent from test subjects and the long-term health effects on exposed personnel.

In September 1994, the U.S. General Accounting Office (GAO) revealed that from 1940 to 1974, the Department of Defense (DOD) and other national security agencies conducted extensive studies involving "hundreds, perhaps thousands" of weapons tests and experiments with hazardous substances. Dugway Proving Ground, a military facility situated in the remote Great Basin desert of Utah, about 80 miles (130 km) southwest of Salt Lake City, played a central role in these tests.

Between 1951 and 1969, Dugway was the site of numerous open-air experiments that could affect humans, animals, and plants. The impact on local residents exposed to these potentially harmful agents remains largely unknown. Civilians in urban areas, on subways, and at airports were subjected to supposed disease-carrying mosquitoes and aerosols containing dangerous various chemical, and radiological agents, including stimulants that were later found to be more hazardous than initially thought.

The project’s details remain partly classified, with the U.S. government gradually releasing information, often incomplete, and the exact number of exposed veterans or civilians likely will never be fully known. Efforts continue to document and address the impact on those involved. But was it ever really stopped?

The similarities between MKUltra and Project 112 are too significant to ignore. Both projects demonstrated a willingness to sacrifice ethics for perceived strategic advantages, often at the expense of human rights and public trust. The secrecy and obfuscation surrounding these projects make it difficult to determine the full extent of the involvement of McCloy, the World Bank, and other powerful individuals and institutions in these covert operations.

McCloy and McNamara’s careers exemplifies the intricate web of connections among the architects of American power, revealing a complex tapestry of influence that often operated behind the scenes. The alignment of these projects under figures associated with both intelligence and the World Bank raises important questions about the intersections of power, finance, and covert operations. The striking parallels between MKUltra and later projects suggest a continuity of approach and a shared underlying philosophy that prioritizes control and manipulation, often at a great human cost.

The Devastating Impact of Operation Ranch Hand on Soldiers and Civilians

Operation Ranch Hand, the U.S. military project involving the spraying of herbicides like Agent Orange over Vietnam, was authorized at the highest levels of the U.S. government. President John F. Kennedy played a pivotal role in approving the use of these chemicals in 1961, as part of a broader strategy to counter the Viet Cong insurgency and support the South Vietnamese government.

Secretary of Defense Robert S. McNamara, who was deeply involved in Vietnam War strategy, supported and facilitated the implementation of the operation. The Joint Chiefs of Staff and military leaders, including General Paul D. Harkins, commander of the U.S. Military Assistance Command, Vietnam (MACV), were also instrumental in its operational oversight. Operation Ranch Hand commenced in 1962 and continued until 1971.

The motto of the "Ranch Handers" was "Only you can prevent a forest," inspired by the famous Smokey Bear slogan from the U.S. Forest Service. Over the course of a decade, the operation led to the significant damage or destruction of more than 5 million acres (20,000 km²) of forest and 500,000 acres (2,000 km²) of crops. Approximately 20% of South Vietnam's forests were treated with herbicides at least once.

The authorization of Operation Ranch Hand marked the beginning of a controversial chapter in the Vietnam War, with the 7th Air Force conducting extensive spraying missions to defoliate forests and destroy crops. The herbicides deployed included Agent Orange, Agent Blue, Agent White, Agent Pink, Agent Green, and Agent Purple. These chemicals were primarily composed of various toxic compounds, including dioxins (notably TCDD in Agent Orange), which are highly carcinogenic and persistent in the environment. The use of these chemicals was not limited to military targets; they were also extensively sprayed over civilian areas, leading to severe environmental contamination and direct health impacts on the Vietnamese population.

The long-term effects on American soldiers who were exposed to these chemicals have been severe and enduring. Veterans have suffered from a range of serious health issues, including various cancers such as lymphoma, leukemia, and prostate cancer, as well as respiratory problems, neurological disorders, and diabetes.

Chronic health problems such as persistent skin conditions, liver damage, and reproductive issues have also been reported. Additionally, exposure to these chemicals has led to an increase in birth defects and health conditions among the children of affected veterans. Despite the recognition of some health issues by the U.S. government and the provision of benefits and compensation through the Department of Veterans Affairs, the enduring impact of herbicide exposure continues to affect many lives, highlighting the profound long-term consequences of this operation.

Reorganizations

To enhance U.S. military capabilities, McNamara established the United States Strike Command (STRICOM) in December 1961, authorized to draw forces from various branches for rapid response to global threats. He also increased airlift and sealift capabilities and consolidated intelligence and communications functions under the Defense Intelligence Agency and Defense Communications Agency. Additionally, he set up the Defense Supply Agency to unify supply procurement, distribution, and inventory management. Does that look like the World Bank globe? Hmmm?

Systems Analysis

McNamara's implementation of systems analysis as a decision-making basis for force requirements and weapon systems sparked much debate. He emphasized considering decisions in a broad context and reducing complex problems into component parts for better understanding. His methods, often overriding military opinions, were unpopular with service leaders. The Planning, Programming, and Budgeting System (PPBS), spearheaded by McNamara, aimed to produce a long-term, program-oriented defense budget and became the core of his management approach.

Cost Reductions

McNamara's cost reduction program, claiming to save $14 billion over five years, included closing unnecessary military bases and other measures despite congressional criticism. Despite the nuclear arms race and Vietnam War buildup, McNamara aimed to balance effectiveness and efficiency in defense spending.

Speculated Connections Between Robert McNamara and the Kennedy Assassinations

Robert McNamara's tenure as Secretary of Defense under President John F. Kennedy and his subsequent leadership at the World Bank have led to speculation about potential links to the assassinations of JFK and his brother, Robert F. Kennedy. JFK's push for de-escalation in Vietnam and his calls for financial reforms challenged entrenched interests, particularly those benefiting from the military-industrial complex and global financial systems.

Robert McNamara's involvement in escalating the Vietnam War and his role in shaping World Bank policies, which emphasized free markets and structural adjustments, could have put him at odds with the Kennedy administration’s more progressive stance.

This friction, combined with McNamara's substantial influence, might have contributed to the tensions that some speculate could have played a role in the political dynamics surrounding the Kennedy assassinations.

In March 1968, Senator Robert Kennedy, who was challenging Johnson in the Democratic primaries, asked his "friend" McNamara to record a statement praising his leadership during the Cuban Missile Crisis for a TV ad. It was odd that despite it violating World Bank rules, McNamara agreed, praising Kennedy's "shrewd diplomacy." It was asserted that McNamara supposedly felt guilty for previously refusing Kennedy's requests to resign from the World Bank presidency. The New York Times criticized him for this, leading McNamara to fear he might be fired. But who knows what really transpired with the Kennedys leading up to them both being assassinated? Can we truly buy the official narrative?

A safe was installed in McNamara's World Bank office to store his papers from his time as Defense Secretary, a courtesy extended to former Defense Secretaries. When the Pentagon Papers were completed in April 1969 and brought to him, it was also odd that McNamara angrily refused to see them, wanting to distance himself from the Vietnam War and his former job.

With John J. McCloy, the second President of the World Bank, and other dubious figures associated with the Warren Commission investigating JFK's assassination, it seems unlikely that the full truth will ever be revealed.

Program Consolidation

A hallmark of McNamara's tenure was the consolidation of programs from different services to reduce redundancy and waste. This included directing the Air Force to adopt Navy combat aircraft like the F-4 Phantom II and the A-7 Corsair II. However, his push for premature adoption of the untested M16 rifle led to failures in combat, and the TFX project, intended to create a dual-service aircraft, faced significant challenges but eventually found success in certain roles.

Cuban Missile Crisis